For those who flourish on excitement and quick decision-making, Intraday trading also known as day trading is a journey full of opportunities to gain profits from the market’s daily ups and downs. With an intelligent approach and smart strategy and a bit of discipline, even beginners can cash in on quick wins.

This Intraday Trading Advice spills expert-backed tips and some Profitable Intraday Trading Advice made just for 66unblockedgames.com readers. Wanna outsmart the competition?

A. What Is Intraday Trading?

Briefly explained Intraday trading revolves around purchasing and selling stuff like stocks, currencies, or commodities ,on the same day. What is the goal of intraday trading? The goal is to utilize quick price jumps and gather up small profits. The investment isn’t long term at all. You need to have a solid strategy, and know the tips and tricks to make things work in the market.

B. Why Should You Master Intraday Profitable Trading Advice 66unblockedgames.com?

- Fast Profits: Take the daily price swings for quick profit.

- Freedom: Trade as you want—either part-time or full-time.

- Learn & Grow: Improve your market game and decision-making instincts.

- Small Start: Start at a a smaller scale , level up your market game slowly,

C. Key Steps to Profitable Intraday Trading Advice 66unblockedgames.com

1. Pick the Right Trading Platform

A strong trading platform is the building block of your intraday game. Here’s what to seek:

- Low Brokerage Fees: Keeping the costs down would help keeping the profits up.

- Real-Time Data: Get quick market updates.

- User-Friendly Interface: Smooth pathways will lead to quick decisions.

Always do your research before starting.

2. Build a Perfect Trading Plan

A solid plan is the key to survival in the world of intraday trading. Here are the requirements :

- Entry & Exit Rules: Set fixed price points to get in or redeem.

- Profit Targets & Stop-Loss: Stick to the wins, exit early when losing.

- Capital Allocation: Don’t risk everything that you have—strategically use small portions of your funds.

There is no room for hit and trial, devise a soild plan and make it work.

3. Read the Market Mood

Know the vibe of the market and move accordingly.

- Follow the News: Keep an eye on global events and happenings in your favorite sectors.

- Sense the Sentiment: Take a look at tools like sentiment analysis or just track big indices (NASDAQ, Dow Jones, etc.).

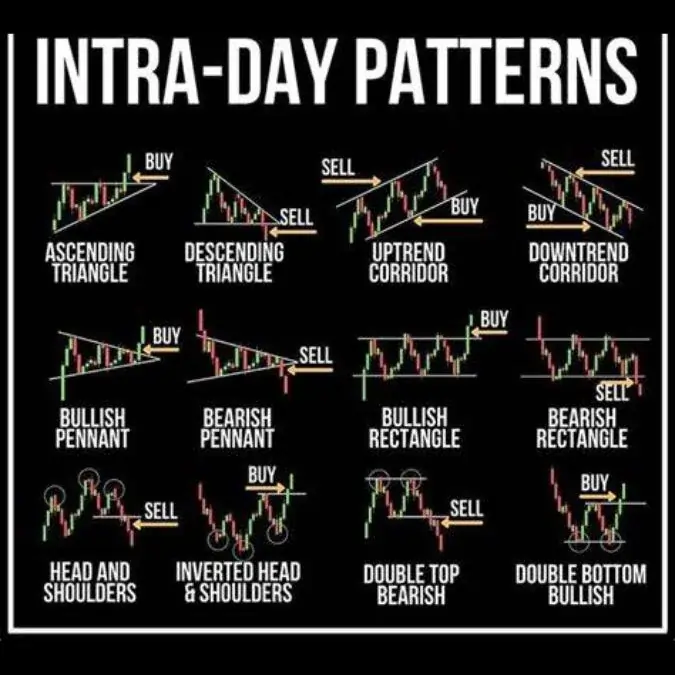

4. Get Friendly with Technical Indicators

Indicators are your best friends. Here are instructions for beginners.

- Moving Averages: Be sharp enough to spot trends and know when things would work.

- RSI (Relative Strength Index): You must find out if the market is overbought or oversold.

- Bollinger Bands: Unravel price swings and potential breakout zones.

Don’t complicate things. Start simple and then stack more tools as you move further.

The Extraordinary Story of Malia Manocherian: Inspiration in Motion

D. Common Mistakes to Avoid:

Avoiding these mistakes can keep your profits high and stress levels low:

- Overtrading: Don’t be emotional and stick to your plan.

- Skipping Stop-Loss Orders: Big no-no! Always set your stop-loss—it’s like your safety net for when things go sideways.

- Trading on Emotions: Fear and greed cannot bear the expense. Stay calm and disciplined and move logically.

E. Advanced Intraday Trading Tips:

1. Master Risk Management

Risk management is the key to success in trading. Follow the basics.

- Position Sizing: Never invest your everything for success of a single thing. Invest little chunks of your capital.

- Stop-Loss Orders: Use auto-exit feature to minimize losses. Set it and stay low risk.

- Risk-Reward Ratio: Keep your goals high. Go for deals where gains outweigh losses.

2. Get the Timing Right [check Entry and Exit Points]

When talking about intraday trading, timing is everything. Here’s how you can avail it.

- Pre-Market Analysis: Keep an eye on previous day’s close, major support and resistance areas.

- Trade Breakout: Spot moves that break key levels. Jump on them.

- Scalping Opportunities: Snag those little price changes multiple times a day. Quick wins make big difference.

3. Stay Consistent and Adaptable

Consistency and flexibility will lead to Success

Market doesn’t stand still, so neither should you. Stay in touch with market shifts ,review your moves and adjust your strategies accordingly.

F. Tools and Resources for Intraday Traders

Improve your trading skills by using the accurate tools. Here’s how:

- Charting Tools: Use tools like TradingView or MetaTrader. Clean charts, smart insights.

- News Updates: Stay ahead of the market. Make use of sources like Bloomberg, Reuters, or CNBC.

- Trading Journals: Keep record of your trades. Review and learn from experience.

These tools are a game changer if used in a right way.

G. Example: Intraday Trade Walkthrough:

Scenario: You see a tech stock brewing in the pre-market trading. Looks quite promising.

Entry Point: It goes through resistance at $140, backed by solid trading volume. Hurrah, you’re in.

Stop-Loss: Tighten it up at $128. Play safe and don’t risk everything.

Profit Target: Target for $145. That’s a good 1:2 risk-reward ratio.

Result: The stock goes to $145. You gain a neat 3.3% profit. One trade and one win.

H .Profitable Intraday Trading Advice For Novices:

Here are some Intraday Trading advices for newbies.

1. Do Your Research Before Buying

1. Do Your Research Before Buying

Never rush into buying stocks when trying to make money from intraday trading. You need to do your homework first. Make use of your top 8-10 stocks for important news that could make big changes, like mergers, bonus declarations and dividend dates. Work on support and resistance levels also.

It will help you make sharper moves.

2. Stick To Big-Cap Stocks

In Intraday trading know one important thing: close your slots before the day ends.

Aim for big stocks, not the little ones. Large-cap stocks from well-known companies are a safe to play with since they trade at high volumes, making them quite easy to trade.

3. Set Your Price Points and Stick to Them

Before you jump in, fix your entry price (where you are going to buy) and exit price (where you are going to sell). Analyze using charts and other data to decide these points, then don’t stray from them.

A lot of people lose on profits because they sell stocks too early, expecting a greater rise that never comes.

4. Use Stop-Loss Orders

One good tip is too set a stop-loss order. This protects your investment by automatically selling your stock if it falls to a specific price. When prices move against you, this is a lifesaver . In this way, you’re not stuck in a losing trade.

5. Take the Money and Run

Intraday traders usually get trapped in rising stock prices and are uncertain to sell once they hit the target. They think the market will keep going up but it doesn’t. Stick to the plan you made. As you hit your goal, gather the profit and don’t stand for more.

6. Don’t Get Too Attached – You’re Not an Investor

If case you lose your target price, don’t try to stick to the stock in the hope that it’ll bounce back. Don’t make your day trading a short-term investment. This strategy can ruin you. Keep yourself focused and don’t try to play the role of investor if it’s not working.

Conclusion:

Intraday trading is not about running after fast profits—it incorporates discipline, solid technique, and consistent learning. Make use of the tips and avoid the usual mistakes. In this way you’ll build a strong base. It is like a marathon, not a sprint. Start at a small level, stay steady and consistent, and let your skills sharpen over a period of time.

Are you ready to explore the interesting world of intraday trading? Start your carrier and intraday journey now with these worthful strategies and unlock your journey to Profitable Intraday Trading Advice only at 66unblockedgames.com!

Alexander is the founder of Puns Party, a dynamic platform that bridges the gap between information and entertainment. Offering insights into business, technology, fashion, and entertainment while infusing humor, Puns Party delivers content that is both engaging and thought-provoking.

1. Do Your Research Before Buying

1. Do Your Research Before Buying